How To Invest in Fine Art in 2022

The crypto market is in a bull run and the stock market has seen historic gains in 2020, most people would not be looking at other sources of investment in 2021. However, rest assured, the current state of affairs is far from the norm.

Historically, artwork investments have been the per-view of the wealthy. However, technological advancements don't just mean that anyone can work remotely. With the rise of fractional investing, platforms like Otis and Masterworks are creating space for investors like you and me to invest in this age-old form of investment. What is fractional investing you ask? Fractional investing simply means that instead of buying a whole piece of art that can cost upwards of millions of dollars, these platforms buy the artwork for you. They then divide the value of the artwork into issuable "shares", much as you would do in the stock market, and then issue these shares to art "shareholders" like you and me!

Why is this an enticing investment space? Because historically, Blue chip artwork has outperformed the stock market! It is also a really good way to diversify your investment portfolio and minimise risk because even if the stock market crashes (which it tends to do periodically), the artwork will often still go up in value! However, bear in mind that while the artwork is a good and stable source of income it is not a "get rich quick" investment. You will likely need to hold your investment for a long period of time - sometimes even a decade.

2 Ways To Invest in Art

The approach to art investing can vary depending on your own interest and access to capital. While some investors approach art as purely an investment strategy, others are in it for love. If you have absolutely no idea or interest in art aside from the profit it may be better to go in the direction of Fractional Investing. On the other hand, if you are interested in art and might be interested in owning a few pieces (even if for a short period of time), you can look at holding and flipping art for a profit.

Fractional Investing via Masterworks or Otis

If you're of the type who is not interested in actually owning the piece of artwork and view this form of investing purely as a profitable venture to diversify your portfolio, then this is the kind of investing you should be focusing on.

Masterworks

Masterworks is a great platform that enables everyday people like you and me to invest in blue-chip artwork. Founded in 2017, Masterworks is the first company in the world to allow investors to buy shares representing ownership of great masterpieces by artists like Warhol, Monet, and more. Previously, this was only accessible to extremely wealthy people who would invest in these high-value pieces and, which would then enter their private collection, completely disappearing from the public eye. They would only reappear when being sold for millions of dollars.

According to Artprice, from 2000-2018, blue-chip art has outperformed the S&P 500 by 180%!

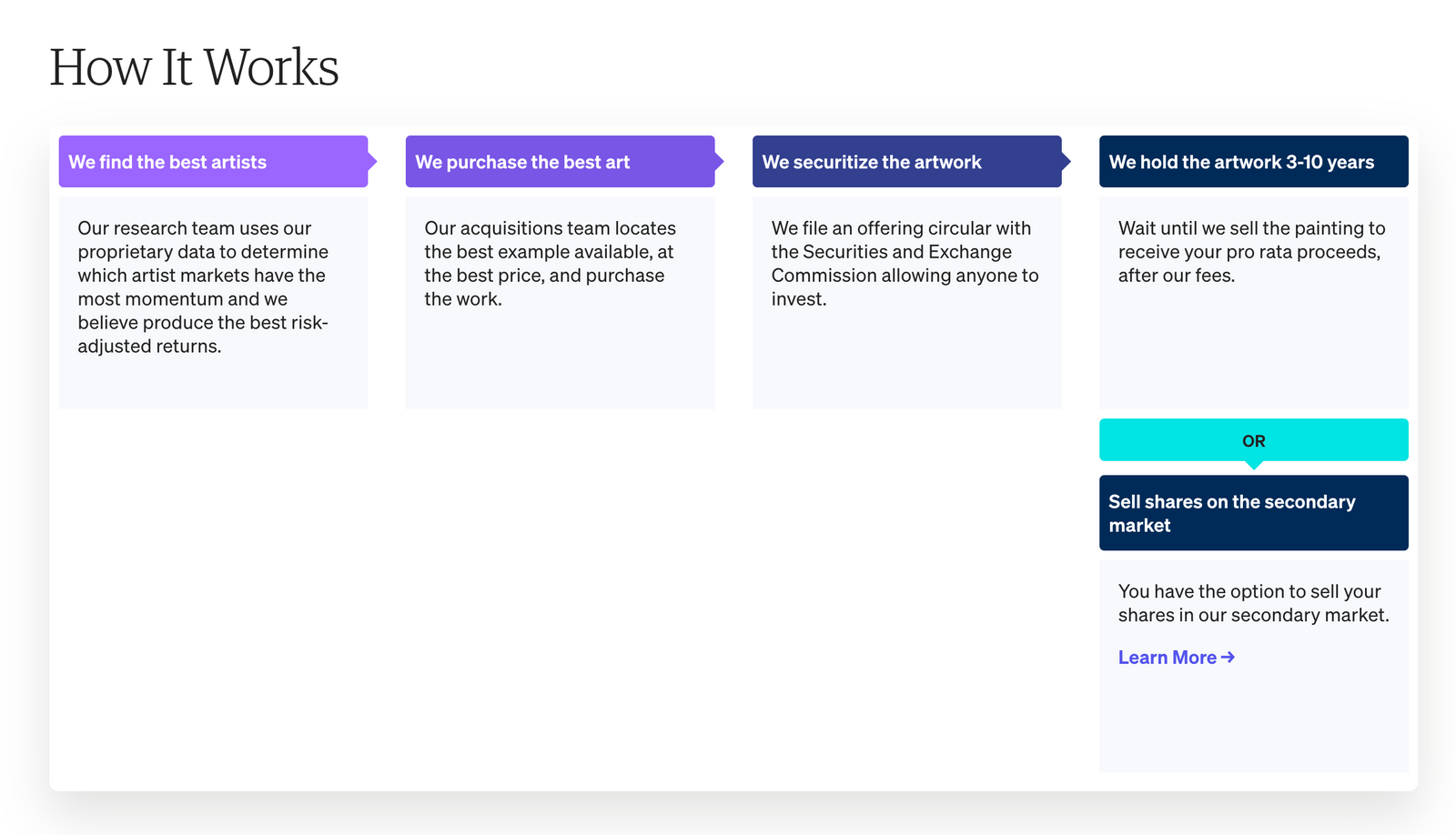

How does Masterworks work?

The process is straightforward. After buying a piece of art, Masterworks registers it as a company with the Securities and Exchange Commission. They then sell shares to individual investors for as little as $20 each. They tend to hold the artwork anywhere from 3 to 10 years. However, if you don't wish to hold your shares for that long, you can sell them on the secondary market!

Masterworks' main focus on “blue-chip” art, which is art produced by the top 100 artists. This is because their work is reliably profitable.

Fees: Masterworks charges an annual 1.5% management fee which covers storage, transportation, and insurance. Moreover, Masterworks will keep 20% of any profit made on the sale of an artwork. These are fees to keep in mind because while art is a lucrative investment opportunity, high fees can slowly chip away at your profits.

Otis

Otis is another platform similar to artwork. Here you can invest fractionally in a range of collectables, not just limited to art. Similar to Masterworks, each cultural asset on the platform has been registered with the SEC and broken into shares.

Fees: They typically charge an approximately 5% fee, which includes a sourcing fee and helps cover insurance, shipping and storage costs, as well as the 1% fee charged by their broker-dealer on invested capital. In addition to this, they are also entitled to receive 10% of the profit on the sale of an asset. However, it is up to them to waive the payment of this amount at the time of sale.

Art Flipping

The other alternative to fractional investing in art, if you happen to have a fair bit of capital by your side, is to flip pieces of art.

Like we do with homes, cars and in the digital world, domain names - flipping artwork is the process of buying and quickly reselling the piece for profit. You can expect to hold the artwork for anywhere from 5 to 10 years.

Like homes or cars, you can purchase artwork in hopes of quickly reselling the piece for a profit, typically within 5 to 10 years. Bear in mind, however, that this can be risky business. While some artworks have sold for considerable profit over the years (upwards of 500% in returns in 5 years), others have dropped considerably in value. For example, in 2014 art dealer and collector Niels Kantor paid $100,000 for an abstract canvas by Hugh Scott-Douglas hoping to quickly resell it for a tidy profit. However, after what seemed like a pop in the art market bubble, the value of his painting fell 80 per cent!

Tips and Tricks to Keep in Mind When Investing in Fine Art

Before you go about investing in artwork, we've put together a list of some of our top tips to keep in mind!

- Like in the stock market, always diversify your portfolio. Art should probably only be a fraction of all your investments.

- You're not going to get rich quick. Art is definitely a risky investment, and you're not going to see returns overnight.

- Do your own research. While artists like Van Gogh and Da Vinci are well known by the entire world, there are also up and coming artists who will see the value of their work appreciate greatly over time. If you can identify such artists, you might be able to win big in the future!

- Be aware of the risks associated with investing in art. Just like the stock market or any other investment like real estate, there are chances of a bubble forming which might burst at any time. Make sure you're entering into an investment at the right time and with money you can afford to lose.

To conclude, it’s important to do your own research to figure out how much you can invest and consult with a financial advisor when possible. If done correctly, investing in this asset class can be a fun and rewarding experience!