The Best YNAB Alternatives (Free & Paid!) in 2022

You've been dreaming of an organized, well-budgeted life. Luckily, there are many budgeting tools available to help every aspect from debiting and saving up all the way down to deciding how much time is worth spending on what kind of investments or entertainment activities in order to achieve your goals by next year's end - no matter who made them (you did).

Among the many budgeting apps present in the personal finance ecosystem, YNAB has been a frontrunner and is used by thousands of people since it was founded in 2010. However, with their recent price hike, a lot of people are searching for more economical alternatives. We've put together a list of the best free and paid budgeting apps that rival YNAB in both costs and features so that you can make an informed comparison when picking your new budgeting app.

The Best Paid (& Freemium) Alternatives to YNAB

1. Actual Budget

Pricing: $4/month

Actual is a privacy-first app that comes with all the great features that make for good budgeting software. They pride themselves on being "local first". This means that your data is stored locally and the app works perfectly well without an internet connection. Although your data is synced in the background so that all your devices can have access, this is done in a completely secure and encrypted way.

Distinguishing Features

- Has both a web and a mobile interface and offers syncing across devices

- Local data storage, along with the option to server backup

- They offer end-to-end encryption which prevents them from accessing your data

- Net worth, cash flow, and advanced custom reporting

- Split single expenses into multiple categories

- Powerful, minimalistic, and fast performing user interface

- Copy last month's budget

What's Missing

- No multi-currency support

- Currently, you cannot connect the app to your bank account, but the feature is in the works

2. Lunch Money

Pricing: $10/month 0r $100/year

Lunch Money is the brainchild of a solopreneur who tried to create a solution for a personal problem and ended up with an app that is now used by thousands of people worldwide. Lunch Money is intuitive to use and feature-rich, which is why it has become the go-to budgeting app for a lot of people. It's especially popular within the tech community given it has a developer API that lets you perform actions and automate certain tasks.

Distinguishing Features

- Import directly from your banks

- Upload transactions via CSVs

- Automate imports with the developer API

- Connect your crypto wallets and ledgers

- Native multicurrency support

- Supports file attachments

- Autosuggest a quick budget based on your spending data

What's Missing

- Is browser-based without a mobile or desktop application

- No support for transaction splitting

3. Toshl Finance

Pricing: Tiered pricing; starts at $2.99/month or $19.99/year (free plan available)

Toshl is the most beautiful and simple app for managing your money. The interface makes it easy to see how much you've spent, where what remains of each income source fits into the monthly budget without any math or formulas needed!

Toshl provides an intuitive experience so that users can start tracking their expenditures within moments after creating a new account on our site - no longer do they have to worry about keeping up with numbers as this program does all calculations in real-time right before saving them back into user accounts.

Distinguishing Features

- Unlimited financial accounts

- Support for repeating expenses, incomes, and transfers

- Auto-sync credit cards, bank accounts other financial accounts

- Export your data as CSV, PDF, Evernote, Excel, or Google Sheets

- Graphs to plan your future spending and analyze past spending

- Upload up to 4 receipt photos per transaction

What's Missing?

- Toshl has a mobile and a web-based app but is missing a desktop application

- No support for goal setting

- No quick budgets

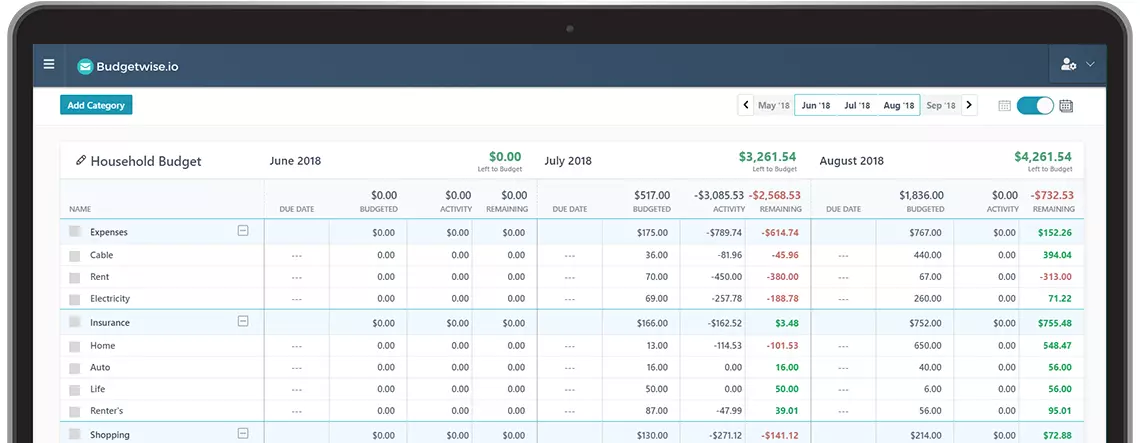

4. Budgetwise

Pricing: Starts at $3/month 0r $24/year

Budgetwise is a new online budget and debt management tool, out with a mission to improve your finances. Although the software has been in early access since December 2017, it's still being developed by its creator Alonso with some help from part-time developers. Despite the slow development process, Budgetwise has already implemented tons of core features and functionality, and by being a part of its early access program, you can help shape the product.

Distinguishing Features

- Account for recurring transactions

- Support for future scheduled transactions

What's Missing

- Doesn't have an option to export your data

- No bank account syncing

- Browser-based without a desktop or mobile app

- No multicurrency support

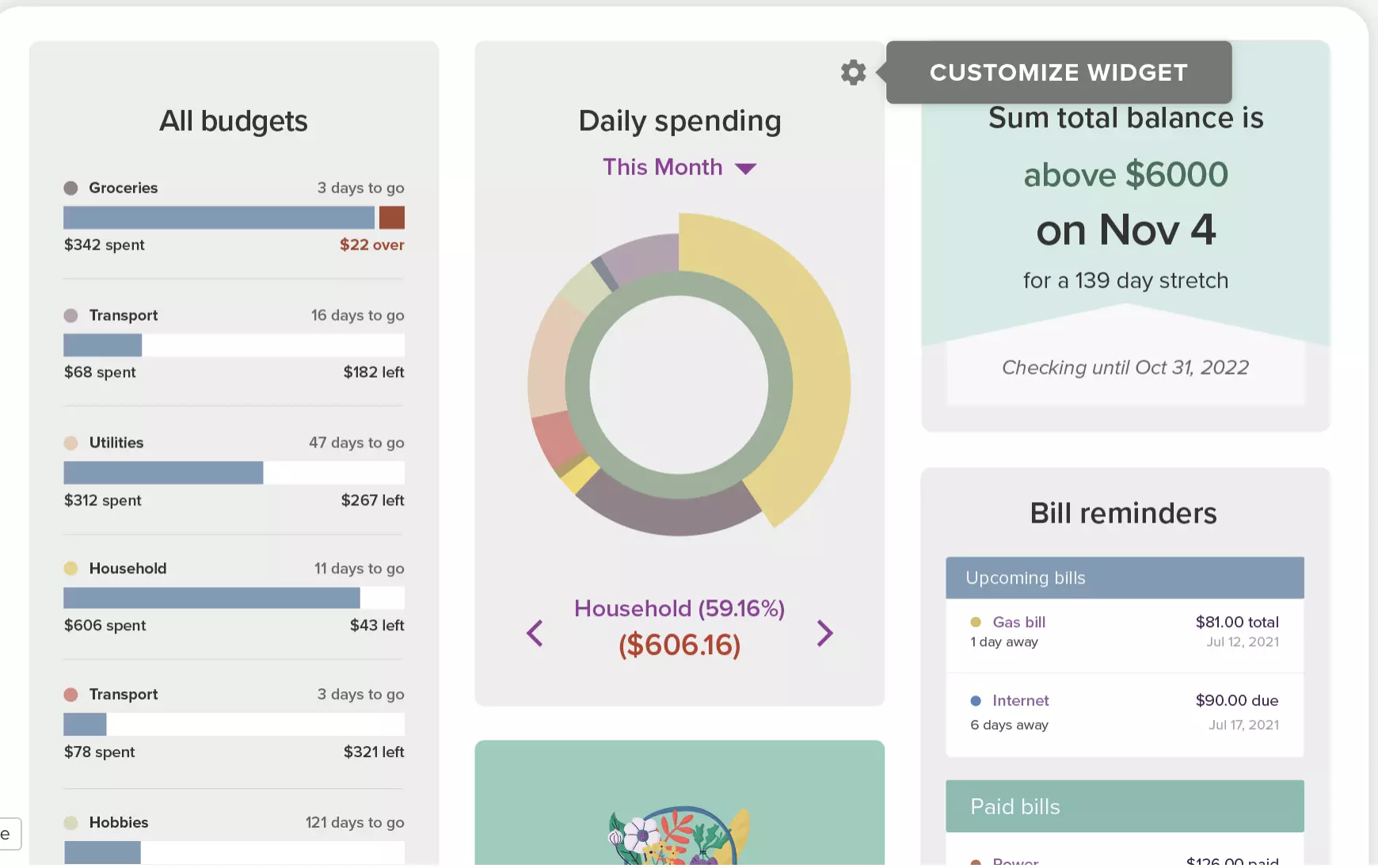

5. Pocketsmith

Pricing: Starting at $7.50/month (free plan available)

If you're looking for a budgeting tool that gives you the ability to accurately forecast your accounts in a way that makes sense and offers a graph, calendar, and cash flow view, Pocketsmith is the app for you! Pocketsmith also syncs with banks around the world and is a great option for people looking for a less US-centric option.

Distinguishing Features

- Allows linking up to 10 bank accounts

- Free basic account

- Automatically import and categorize transactions from over 14,000 banks and institutions worldwide

- Customized dashboards, forecasting and reports

What's Missing

- With a lot of baked-in features, the app tends to have a bit of a learning curve

- The free version only allows for manual entry of data

The Best Completely Free Alternatives to YNAB

1. Mint

Pricing: Completely free to use

Mint is one of the most popular online budgeting tools. It is a frontrunner in the personal finance and budgeting space and allows you to automatically sync your financial accounts all in one place for a well-rounded picture of what you're spending and saving, with an easy log that lets users categorize transactions quickly by category or type if they're not sure which it should go under!

Distinguishing Features

- Set goals for your budget

- Make a plan for paying off depts

- Investment tracking

- Bill reminders

- Free credit score and monitoring from TransUnion

What's Missing

- It's a free app that relies on ad revenue which can leave the user experience a bit clunky

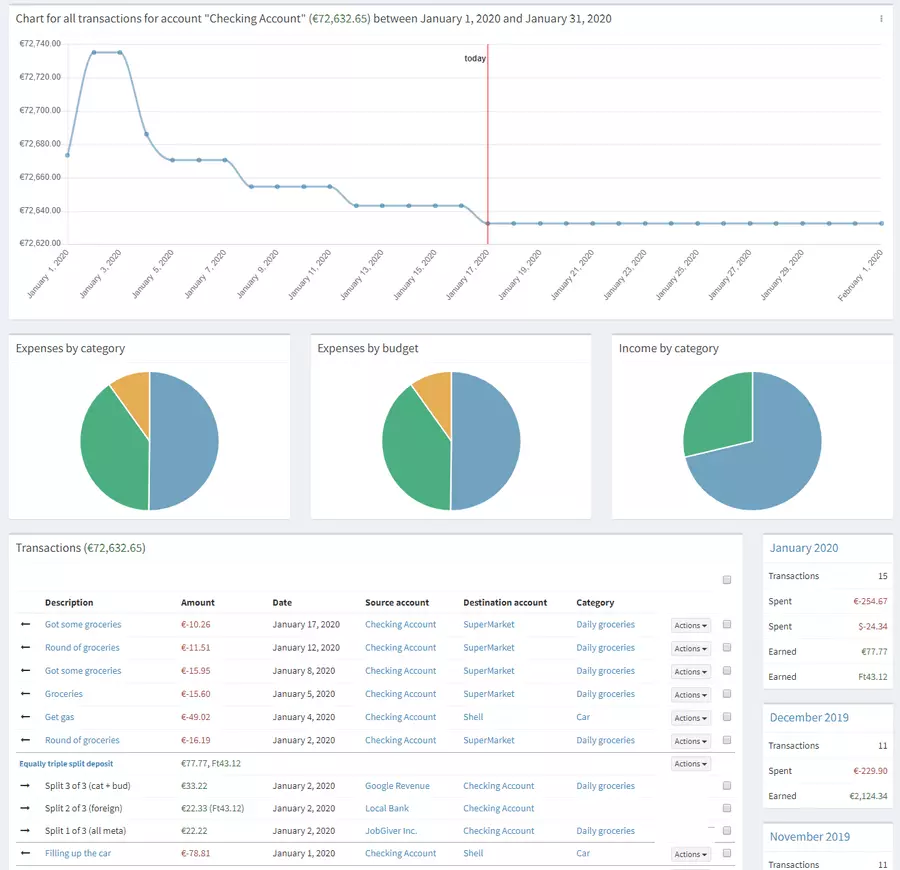

2. Firefly III

Pricing: Free and open source

Firefly III is a self-hosted financial manager. It can help you keep track of expenses, income, and budgets with the use of credit cards or shared household accounts! This software isn't only useful for you to manage your personal finances, but can also be a great tool if you're managing teams within an organization and need access to all employees' salary information quickly at once.

Distinguishing Features

- It's self-hosted so you can completely own your data

- Offers support for recurring, split and scheduled transactions

- You can change your default currency or have more than one currencies

- Set goals for your budget

What's Missing

- It's browser-based and self-hosted so setting up is a bit more complicated than just making an account

- No desktop or (official) mobile app